Payment integration capabilities of leading PSPs – A comparative analysis (Q1 2025)

As of early 2025, the digital payments industry is evolving rapidly, with various Payment Service Providers (PSPs) competing to offer businesses seamless and flexible integration solutions.

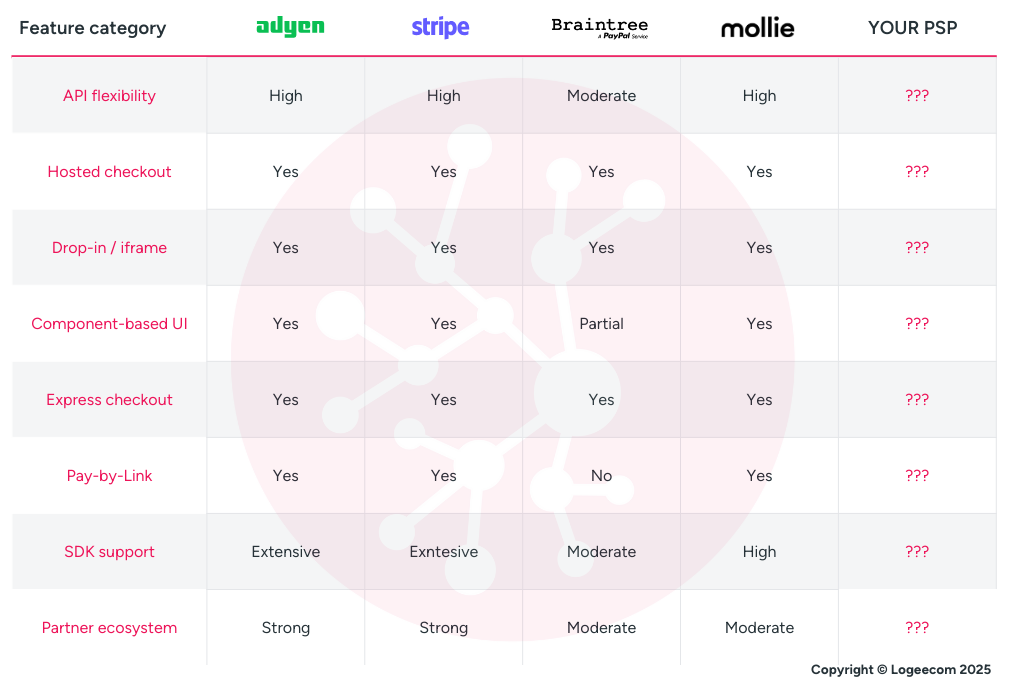

While Adyen, Stripe, PayPal Braintree, and Mollie lead the way in API functionality, SDK support, pre-built integrations, and extensibility, where does your PSP stand?

If your provider isn’t on this list, how does it compare?

The scope and methodology of analysis

This analysis, reflecting the state of PSP integration capabilities at the beginning of 2025, is based on our independent research, utilizing publicly available documentation, sandbox testing, and our direct experience in integrating these PSPs into real-world merchant environments. The findings reflect our expertise in payment integrations and provide an unbiased view of how these providers compare in key areas.

The study evaluates PSP integration capabilities in the following areas:

- API design and flexibility

- Hosted and self-hosted checkout solutions

- Drop-in and iframe integration

- Component-based UI elements

- Pay-by-link functionalities

- Pre-built integrations and SDKs

- Partner ecosystems and extensibility

Key integration models and comparison

Each PSP provides multiple integration options, catering to different business needs. Below is a summary of the most common models:

1. API-only integration

- Provides full control over the payment experience.

- Requires significant development effort and PCI DSS compliance.

- Ideal for businesses seeking a fully customized checkout process.

2. Hosted checkout

- Customers are redirected to a PSP-managed checkout page.

- Simplifies security and compliance but limits customization.

- Suitable for businesses with limited development resources.

3. Drop-in / iframe

- Embeds payment solutions within merchant websites.

- Balances ease of integration and user experience.

- Offers limited customization but ensures faster deployment.

4. Component-based elements

- Provides modular UI components for a tailored checkout experience.

- Ensures security while allowing flexibility in UI customization.

- Suitable for businesses wanting control over UI without backend complexities.

5. Express checkout

- Integrates fast payment solutions like Apple Pay, Google Pay, and PayPal.

- Reduces checkout friction and improves conversion rates.

- Limited customization as UI is controlled by payment providers.

6. Pay-by-Link

- Generates payment links for easy remote transactions.

- Ideal for service businesses, B2B payments, and invoices.

- Requires minimal integration but limits branding control.

Comparative insights: strengths and weaknesses

Where does your PSP stand?

While these leading PSPs continue to innovate, many other payment providers are falling behind in integration capabilities. If your PSP isn’t on this list, consider:

- Does it offer a flexible API with developer-friendly documentation?

- Are there pre-built integrations for major e-commerce platforms?

- How easily can it integrate into your checkout process?

- Is the user experience optimized for seamless transactions?

- Does it support modern payment methods such as digital wallets and pay-by-link functionalities?

If your current PSP lacks these essential integration capabilities, it may be time to explore better alternatives.

Strategic implications for PSPs

To remain competitive in integration capabilities, PSPs should focus on:

- Developer experience: Providing intuitive APIs, robust SDKs, and clear documentation.

- Seamless User Experience: Enhancing integration options to reduce friction.

- Security and compliance: Ensuring PCI DSS and local regulatory adherence.

- Extensibility: Expanding partner networks and pre-built integrations.

- Innovation: Introducing AI-driven fraud prevention and data-driven insights.

Logeecom’s expertise in PSP competitor analysis

At Logeecom, we specialize in providing in-depth competitor analysis for PSPs. Our expertise in payment integration, combined with years of experience working with leading PSPs, enables us to offer:

- Detailed competitive benchmarking: Evaluating where your PSP stands against the industry leaders.

- Integration optimization strategies: Helping PSPs enhance their API and SDK offerings.

- Market positioning insights: Identifying gaps and opportunities for differentiation.

- Custom reports and recommendations: Tailored insights to improve your PSP’s integration capabilities.

If you are a PSP looking to refine your integration strategy and stay ahead of the competition, Logeecom can provide the insights you need to succeed.

Conclusion

This analysis, reflecting the state of PSP integration capabilities at the beginning of 2025, is derived from publicly available data and our direct experience integrating these PSPs into various business ecosystems. While Stripe and Adyen lead in developer experience and integration flexibility, PayPal Braintree remains a consumer favorite, and Mollie continues to refine its offerings with a focus on ease of integration and accessibility

For businesses selecting a PSP, understanding these integration capabilities is essential to ensuring smooth implementation and long-term scalability. If your PSP is not measuring up, it may be time to reconsider your options.

Contact Logeecom today to gain a competitive edge in payment integration.